When you purchase through links on our site, we may earn an affiliate commission.Heres how it works.

The Redmond-based company has been under tax audit and scrutiny by the IRS for nearly a decade.

Microsoft already highlighted that it intends to appeal the IRS’s proposed adjustment.

This means that both entities might spend significant time in the corridors of justice before a decision is made.

The IRS accuses Microsoft of stashing billions of dollars in offshore investments to evade US taxes.

A well-calculated move that would perhaps give the IRS a fighting chance against Microsoft and its vast resources.

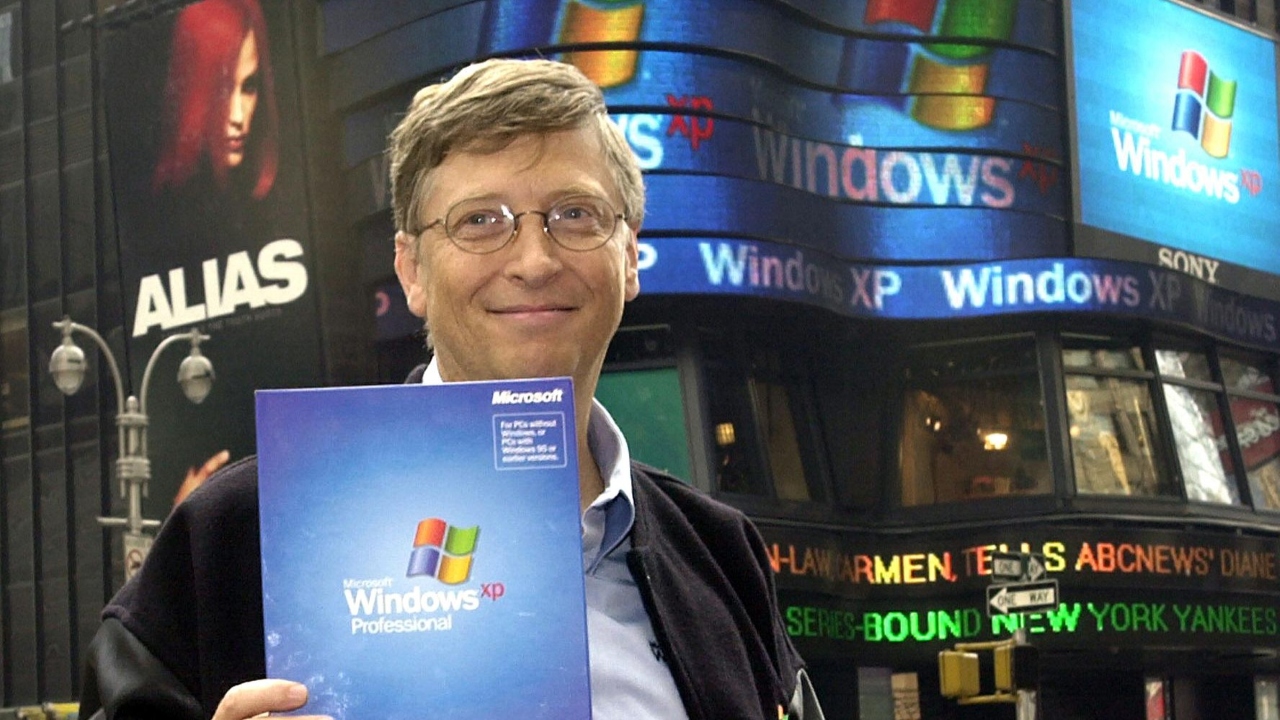

How did Microsoft get here?

Many discrepancies were uncovered per the IRS’s investigation of Microsoft’s revenue channels.

The facility was essentially used to burn Windows and Office software on CDs.

But the case wasn’t a slam dunk for the IRS.

Microsoft’s accounting firm, KPMG, was armed to the nail with documents affirming its claims.

As a result, congress members passed a bipartisan bill that would keep the IRS on a short leash.

But this didn’t deter the IRS from moving forward with its investigation into Microsoft.

This is why the unit was able to look into Microsofts Puerto Rican deal despite intervention from Congress.

What’s next?

Microsoft is moving forward to contest the outcome of the investigation via the IRS' internal appeals division.